This month was primarily focused on technical improvements across our live systems and strategy infrastructure. Several strategies ran in production during October, yielding valuable live data and insights that will guide upcoming enhancements.

1. Statistical Arbitrage

The strategy has been running live throughout October.

Several execution issues identified during the test phase were resolved, improving overall stability.

- Next steps: Add the strategy to the production portfolio in November.

- Future research directions: Remain unchanged — enhancing pair selection stability and exploring predictive models using alternative data sources.

2. Funding Rate Arbitrage

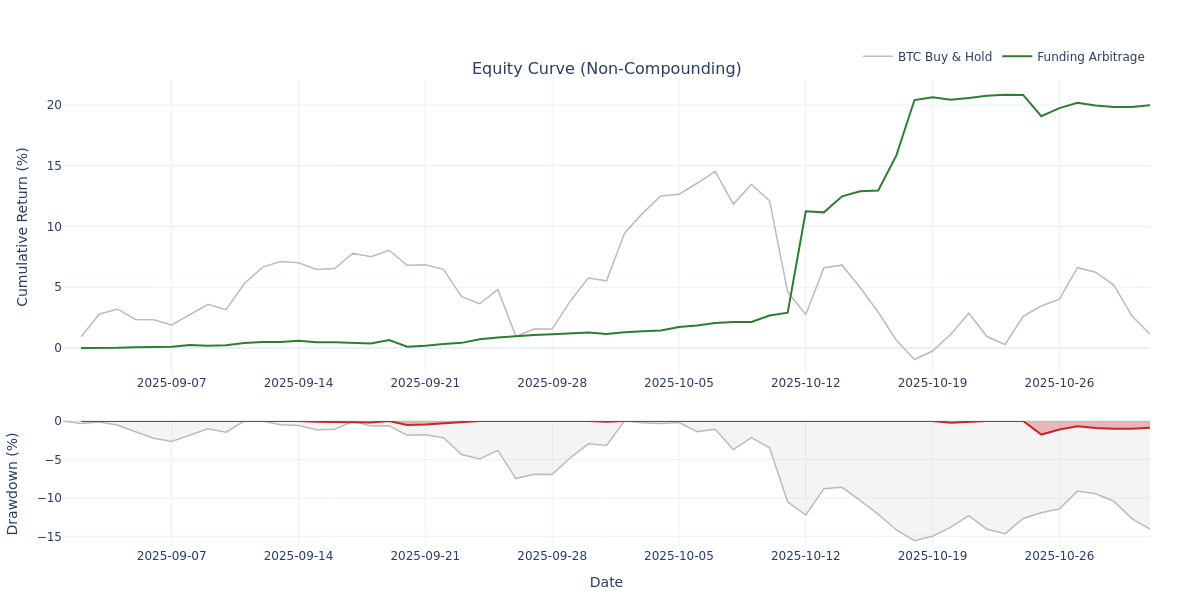

A new research iteration this month identified and addressed data gaps and edge case scenarios, while also improving universe selection. These refinements resulted in improved backtest and live performance.

We are now in the process of scaling the strategy’s AUM.

| Strategy | CAGR | Sharpe | Max Drawdown | Turnover |

|---|---|---|---|---|

| Funding Arbitrage | 221.54% | 4.87 | 2.21% | / |

| BTC Buy & Hold | 0.31% | 0.08 | 17.06% | / |

3. Cross-Sectional Portfolio Strategy

We successfully integrated the Lighter DEX and launched several existing strategies live there. A dedicated pool is planned for launch in November.

The Lighter integration required architectural improvements and, as a byproduct, resulted in a new textual-based UI that enables smooth observability and live strategy management.

4. Momentum Strategy

The Momentum Strategy is scheduled to go live on Lighter shortly.

5. Reversal Strategy

We have been working on migrating this strategy from the Lean to our in-house Qubx framework.

The strategy consists of two parts — a primary trading component and a secondary probabilistic (machine learning) layer. Both components are now fully integrated within Qubx, resulting in:

- Enhanced live observability

- More efficient data usage and computation

- A solid foundation for future development

This migration was initially motivated by the need for better transparency and performance, but more importantly, it now enables further innovation — from testing new primary strategy variations to improving the ML feature set.

6. Live Production – October

In October, the following strategies ran live in production:

- Momentum

- Cross-Sectional Portfolio

- Reversal

- Funding Rate Arbitrage (on a sub-account)

During the October 10–11 market crash, our Momentum strategy held a fully short position approximately 12 hours before the drop, successfully hitting all profit targets.

The Cross-Sectional Portfolio showed up to 30% unrealized profit at the lowest point of the drop. While the profit wasn’t fully realized due to the strategy’s periodic reallocation design, this event highlighted potential improvements we plan to implement in November.

The Reversal strategy entered long positions shortly after the dip and also generated profit.

The week following the drop was marked by some choppy conditions, but overall, all live strategies performed exceptionally well during the volatility spike.

In summary:

October marked significant progress in both technical infrastructure and live deployment maturity. All strategies demonstrated resilience and strong performance during market turbulence, and several key improvements are scheduled for rollout in November.